Nebraska Pass-Through Entity Tax

DeVon Billups, CPA |

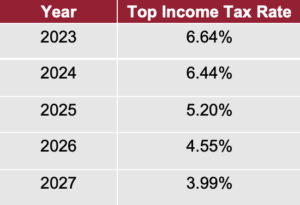

The state of Nebraska recently passed an elective pass-through entity tax for S-Corporations and Partnerships. This presents an extraordinary tax planning opportunity for business owners that reach the $10,000 state and local tax (SALT) deduction limitation on their personal tax return. The pass-through entity tax would be a fully deductible business expense, whereas state taxes paid personally are potentially limited. This election to pay taxes at the entity level is also a year-by-year decision, and businesses can choose not to elect this treatment for tax years where it might not be as advantageous. The creation of this new tax has also opened the opportunity to retroactively elect the treatment for tax years 2018 – 2023. However, this will require case-by-case consideration, so be sure to connect with your friends at Bland & Associates for more information to see how this affects your tax situation! Other relevant information: The table below presents the income tax rate changes in Nebraska (for individuals and businesses) that will result in a reduction from 6.64 percent to 3.99 percent by tax year 2027.

|