We offer competitive solutions

and advisory services for

commercial real estate clients,

residential and industrial

property developers, owners,

investors, managers, agents,

and brokers.

Working with Bland Helps You With:

-

exceed growth

& business objectives -

customize management

-

implement solutions

Working for the biggest and the

best in the region

Serving some of the region’s largest real estate companies has afforded us additional insight into the complex issues surrounding the industry.

Our extensive knowledge allows us to provide consultation beyond traditional accounting, auditing, and tax preparation and offer industry-specific advisory services designed to minimize risk and maximize profitability.

A Comprehensive Understanding of the Real Estate Industry

Understanding the inner workings of the real estate industry helps us give you results and personalized attention, ultimately to improve your bottom line and expand your industry. We do this by excelling in the following:

- exceed growth

& business objectives - customize management

- implement solutions

- financial statement preparation

- income tax preparation

- tax strategies

- deal structuring, including financing & 1031 exchange strategies

- cost segregation studies

- budgeting & forecasting

- cash flow analysis

- accounting procedure

- review & development

- strategic planning

- acquisition due diligence

- property evaluation

- lease analysis & review

- litigation support

- business succession

- planning

contact us

Opportunity Zones

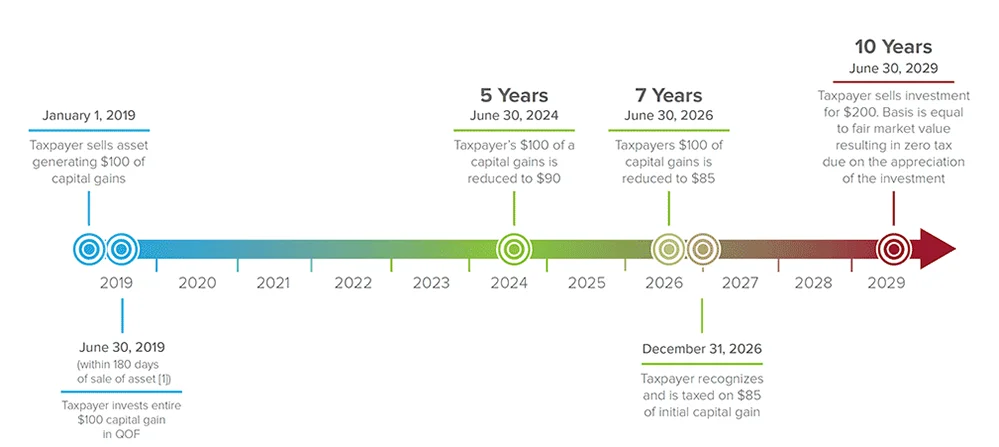

Enacted on December 22, 2017, the Tax Cuts and Jobs Act made several significant changes to the tax code. One of these changes included a new tax incentive program, Internal Revenue Code Subchapter Z – Opportunity Zones, aimed to promote investments in designated low-income census tracts. Participating investors may benefit from deferred and reduced capital gains, including zero tax on the appreciation of the investment at disposition.

The Investment Offers 3 Potential Tax Benefits

All or a portion of realized capital gains is invested in these economically underperforming areas or “opportunity zones” either directly or through a Qualified Opportunity Fund (QOF).

-

1. Tax Deferral

A deferral of the tax on realized capital gains until the earlier of the disposition of the investment or December 31, 2026.

-

2. Tax Reduction

A 10% reduction of the tax if the investment is held for 5 years by December 31, 2026, or date of disposition, and an additional 5% reduction if held for seven years (15% total).

-

3. Avoid Tax Gain

No taxable gain on the sale or exchange if investment is held for 10 or more years.

Under the traditional system, the investor would owe approximately $24 in federal tax (assuming 20% capital gains rate and 3.8% net investment income tax) compared to $20 if invested in a Qualified Opportunity Zone. *Rates are estimates and are subject to change. Please consult your tax advisor.

[1] Investors receiving gains on a K1 may be able to elect December 31 as the date of the gain, regardless of the date of the actual sale.